Are Biometric Payments Safe & Secure: Reshaping the Way We Pay

The global market for biometric payment was recorded at $8.4 billion in 2023 and considering the widespread adoption the market is projected to reach $37.4 billion by the end of 2033, this indicates that businesses are preparing to transform payment methods. The alarming rate at which identity fraud is surging and the tactics malicious actors employ to get access to the financial world to conduct potential transactions, stresses the development of robust technology that can accurately authenticate genuine individuals and stave off spoofed attempts. We are seeing the swift and widespread adoption of biometric payment, owing to the accuracy and reliability of the process.

Quick Insights into Biometric Payment

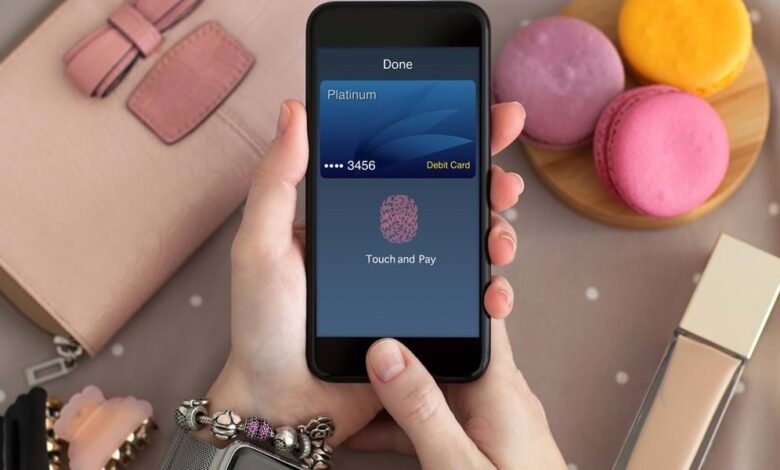

An advanced and secure way to conduct financial transactions, allowing users to make payments by using their unique biometric traits. Fingerprints, facial features, iris, or retina patterns are employed to verify the identity of users and grant users access to make secure payments. Of all biometric identifiers, face payments are considered more convenient and easily accessible, allowing users to conduct transactions just by scanning their payments.

A commercial bank in Taiwan named E SUN launched its first automated ATM in 2019 integrated with facial recognition technology, allowing users to make transactions by scanning their facial landmarks. Face biometric make it easy and convenient for users to make cashless payments, eliminating the need to carry cards or wallets.

The Process Behind Face Payments

Face recognition payment systems ensure accurate and reliable verification of a user’s identity and reduce the threats of bad actors entering the systems and exploiting the financial world for personal interests. The technology works in a series of steps to give accurate results and let’s explore the essence of the science behind face payments.

- The first step is the enrollment of facial data in the form of a facial profile and the data is securely registered in the databases which is later used for authentication purposes.

- Before a user makes payments or conducts wire transfers, precise authentication is performed. For this purpose, the person wanting to make payments comes in front of the face recognition payment system and scans his face, which is matched against the existing databases.

- For accurate matching of the scanned face with registered data, the user is granted authorization and allowed to make payments or avail of financial services.

Benefits of Using Face Recognition Payment System

Biometric payments come forth as a secure and reliable alternative to traditional payment methods which rely on passwords or PINs. With technological progress, the world has shifted towards digital banking and online payment methods, to access such services user names and passwords are required which are prone to hacking or replication. Face payments are taking the world by storm, offering secure financial transactions and payments, making it challenging for cybercriminals to forge minute details and get unauthorized access.

- The proliferation of mobile banking and digital financial services has increased convenience for users, allowing them to perform transactions without any hustle, saving time and energy. The integration of the face recognition payment system into digital banking has increased opportunities and provided flexibility to users in managing their money safely.

- Face payments offer enhanced security and preserve the integrity of confidential information against spoofing or hacking. It reduces the potential risks of financial activities by granting access to authorized individuals only and actively detecting spoofed attempts.

- Financial inclusion is significantly increased with face payments as the communities in underdeveloped areas or who have no access to banks can easily make digital payments by using their unique biometrics.

- Most crucially, payments through biometrics are expedited and swift, allowing users to conduct transactions or make wire transfers in a matter of seconds.

Challenges & Limitations

Biometric payment not only secures financial services but also empowers users to control their financials. Despite the remarkable applications, some concerns and challenges are limiting the widespread adoption of the technology.

- Implementation of face payment tools requires high costs for the development of infrastructure and advanced facial recognition software, making it challenging for small-sized businesses to integrate the technology. Moreover, high investment is also required for maintenance, storage of biometric data, and staff training, limiting the widespread adoption.

- People are often concerned about the collection and storage of their biometric data and who has access to their confidential information. Furthermore, concerns regarding security features and what measures are taken to bypass data breaches are also provoked.

- The most important challenge is user acceptance, people like to adopt the technologies they are familiar with and find it hard to adopt new technology.

The careful and responsible implementation of the face recognition payment system and the development of clear & transparent policies can mitigate privacy challenges. Raising awareness and educating people about the use and advantages of technology can enhance user acceptance effectively.

Final thoughts

People are also inclined to transition towards passwordless authentication and cashless payments, highlighting users prefer convenience and easy accessibility. Businesses are switching their services with biometric payments to enhance security and make it easy for users to conduct transactions, indicating the surge in market growth of the industry.